5 Steps to Protect your Business from Inflation in NZ

High Inflation is forecast in 2023 & 2024: Take action to prevent your business from being hit hard!

2500 years ago, the Greek philosopher, Heraclitus is quoted saying "change is the only constant in life".

In 2022, all business owners can attest to increasing costs being a weekly occurrence.

This article will help you to understand what Inflation is, why it's happening, and, importantly - what you can do to minimise its effect on your business.

Definition: Inflation

Inflation is a general increase in prices and a fall in the purchasing value of money.

In simple terms – everything costs more!

Inflation is commonly measured using the consumers price index (CPI) which records and compares the prices of key goods and services. This common measure is a simple indicator but relies on a limited 'basket' of consumer goods and services that often underrepresents the increasing costs felt by businesses and consumers across the board.

When looking at inflation as it relates to a business, we're also interested in measuring inflation by the business price index (BPI), as this includes specific data that can be used to inform business recommendations and decisions made by clients of Business Consulting New Zealand.

What’s causing this Inflation?

There are a range of internal and external economic factors that are fueling the current inflation. In our opinion, these have compounded to create a perfect storm for rising prices.

Key factors causing the current inflation include:

Pent-up demand caused by COVID-related lockdowns and supply chain issues. When supply resumed, demand spiked.

A steep increase in International shipping costs, effectively increasing the price of almost all imported goods into New Zealand.

Similarly, increasing international oil prices, resulted in Kiwis paying significantly more at the fuel pump and many businesses increasing their prices as a result.

The government provided much stimulus and used monetary policy to keep the economy moving throughout the COVID era. This injected a huge amount of 'cheap money' into the economy.

International supply chain issues are being impacted by various world events such as Russia's invasion of Ukraine, which is driving up the costs of goods both in New Zealand and abroad.

The current rate of Inflation in New Zealand

Inflation is the highest we have seen in New Zealand for over 30 years.

In the year ended September 22, the annual CPI report by Stats NZ indicated that prices had increased by +7.2%, and the BPI shows that costs to production businesses have increased by +9.2%.

Many businesses that we work with have already felt the pressure of inflation, reporting widespread cost increases that significantly exceed the above figures.

Here are a few statistics that show increasing prices that will affect businesses and consumers alike:

Farm expenses are up 15.6%

Fertiliser is up 54.7%

Capital goods prices are up 12.1%

Water, plumbing and drainlaying services are up 25.3%

Diesel is up a whopping 80%

Construction is up 13.2%

Panels, boards, veneer sheets, and plywood is up 25.6%

The changing $NZD

Compounding the inflation we're experiencing, the New Zealand Dollar is weakening, further increasing the cost of many international and domestic purchases.

As we've seen in previous times of recession and inflation, the New Zealand Dollar ($NZD) has fallen significantly against the world's reserve currency, the US Dollar ($USD).

This phenomenon often happens during times of uncertainty, when the world has more trust and confidence in the US Dollar than in other currencies and assets. The result is a higher demand for the $USD, pushing up its value and effectively devaluing other currencies and assets, including $NZD as we've seen of late.

The low exchange rate against the United States further increases the price of international trade, with the resulting price changes adding fuel to the inflationary fire.

Here's the important part:

Costs have increased in the last 12 months by a percentage greater than the net profit margin of most New Zealand businesses. If businesses don't have strategies to deal with inflation and price increases, they won't be sustainable.

Can I do anything about Inflation?

The short answer is NO.

Inflation is primarily controlled by the Government, Monetary Policy, and International & Local Economic situations and events. As an individual or regular business, there is nothing you can do to influence the national or global rate of inflation.

5 Steps to Protect your Business from Inflation in NZ

For Business Owners to succeed, they need to manage a wide range of business strategies and ongoing operations. This limits their focus, so bringing in specialist advisors and consultants will fast-track growth and help avoid common pitfalls.

If you want to protect yourself and your business from going through times of great difficulty and continue to maintain a profitable and growing business, we suggest considering some or all of the 5 Steps listed below.

All of these strategies come down to basic principles of improving a business, including:

Improve efficiencies

Reduce costs & expenses

Increase profit margins

If you'd like more specific advice relating to your business, we suggest making the most of our free & no-obligation Business Diagnostic.

What these steps ultimately come down to, is understanding what options are available to us, and taking action to make the changes that are required.

As Albert Einstein said, "The measure of intelligence is the ability to change."

1. Understand what you can and can't control

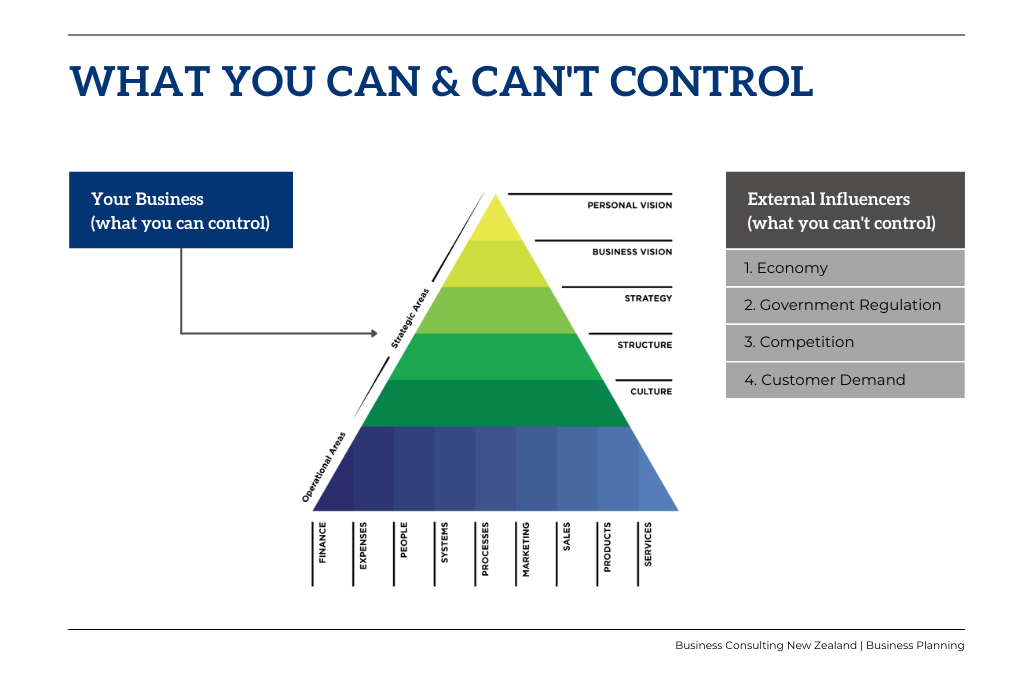

When our Business Success Partners work with a New Zealand Business client, they're quick to point out the parts of a Business that are within our control, and the things that aren't – the things we can and the things we can't change.

The parts of a business that we can control are internal (within the Business) and include the Strategic and Operational Elements of the Business.

The things that affect a business that we have no control over are external influencers including economic and governmental decisions - including inflation.

Our focus is to have a clear understanding of the external influencers so we can make the best decisions, by changing what we can control (the internal elements).

Many individuals concern themselves with emotionally loaded subjects that they can't control.

And when prices go up, heck, even when there's the discussion of prices increasing - it triggers fear and worry about the future. As previously discussed, this is something we simply can't control - so we should accept these and adjust the things within a business that we can control.

Step 1: Understand what you can and can't control - and focus your efforts on adapting the things that you can change. Going one step further - seeing this as an opportunity to make your business more efficient and resilient will help keep you in a strong frame of mind.

2. Streamline and automate processes

Making your business more efficient and reducing costs should be at the forefront of your operation to control your business expenditure, particularly during times of inflation.

This will allow your business to maintain more consistent pricing in an environment where everything else is increasing, effectively making your offering better value and more attractive.

Consider the processes within your business and automating where possible can have the following impacts:

Reduction in the time taken to complete a process

Reduction in the manual input required

Increase in quality and/or consistency of output

Increase in the quantity of output.

Individually, and combined, these will help achieve the goal of lower costs and improved efficiencies.

What processes can you streamline or automate?

Anything that is done on a repetitive basis! Some common processes we see simplified and automated include:

The sales process – If you can speed up the sales process and increase the volume of sales, you'll increase revenue and cash flow.

Manufacturing/production processes – Putting in standard operating procedures and processes will help to improve the consistency of output, reducing the time taken and the likelihood of a quality issue through standardisation and procedures.

Manufacturing/production automation – Speed up the production process and reduce the manual input required with the right equipment. The investment that this requires may put some people off, but if it's a matter of maintaining a profitable business it will be a necessary step. Keep an eye out for used or liquidated machinery going cheap.

Accounts – With the technology available from Accounting Software companies like Xero it's super easy to slash the time and money being spent on bookkeeping in a business by automating invoicing and receipting.

Customer follow-up – Spend less time managing customers and increase the customer return rate by keeping them top of mind and providing consistent communication with a CRM or similar software.

Step 2: Streamline and Automate processes to improve efficiency, productivity and quality – often in one fell swoop.

3. Improve Productivity

Following on from improving efficiency, improving the productivity of the people within your business will help to reduce costs, increase output and/or increase profitability - all key outcomes when protecting your business from a recession.

Prioritise the activities that have the largest impact on revenue and profitability.

In a labour-based business, this means increasing the number of hours billed to customers.

In a service-based business, this would require a focus on the services rendered within a given timeframe.

Similarly, in a production-based business, improved productivity would relate to the volume of products produced in a timeframe, within a budget.

In a retail setting, this will relate to the number of goods sold within a timeframe.

We suggest completing an analysis of these productivity-critical activities to see where opportunities lay for improvements.

We've written a full article on Labour Recovery & Productivity if you want to find out more about this popular subject.

Step 3: Improve the productivity of the people within your business to improve efficiency, reduce costs and increase profit margins.

4. Reducing Product/Service Range

Reducing your product or service range can help your business to improve efficiency.

We're seeing this phenomenon largely take hold of the global retail and Supermarket industry, where we're seeing ranges reduced from between 12%-25%.

Reducing the product or service range will provide some key benefits:

Larger order quantities gives the opportunity for lower buy prices

A smaller range will require less labour through specialisation and repetition

Marketing spend will be more focused and effective

Step 4: Reduce your product or service range to improve efficiency, productivity and profit margin.

5. Implement a Cost-Control Feedback Loop

With prices increasing so quickly, and the New Zealand dollar fluctuating aggressively, it's easy to fall victim to increasing costs and overheads that are currently eating into margins and slashing the profits of many businesses.

If you aren't on top of these increases, your business (and you) will end up wearing the difference.

To mitigate these price increases and ensure profitability, we recommend implementing a Cost-Control Feedback Loop like the following example:

Set a clear gross profit margin for products/services

Create a cost monitoring system for all key costs to ensure that advertised pricing/quotes are

Reduce the timeframe prices/quotes are valid for

Evaluate profit margins of all business activities every month in a management meeting

Adjust prices as feedback dictates

Although this may appear to be more work and time required in the short term, tight control of margins will ensure the profitability and ultimate survival of your business - making it entirely worthwhile!

Step 5: Reduce your product or service range to improve efficiency, productivity and profit margin.

Change for a better business

Much like Heraclitus identified 2500 years ago, change is going to happen whether we like it or not. We decide to fight it or to accept it and change our businesses to adapt.

If you need help identifying the changes you should make to improve your business (and there are hundreds more) then we suggest taking up our free and no-obligation business diagnostic below. We'll help you to identify where your business is leaking profit, and where the biggest opportunities for a bright future lay.